IBA Reports Half Year 2023 Results – GROUP NET SALES UP 5.9%

Louvain-la-Neuve, Belgium, 31 August 2023 – IBA (Ion Beam Applications S.A), the world leader in particle accelerator technology, today announces its consolidated results for the first half of 2023.

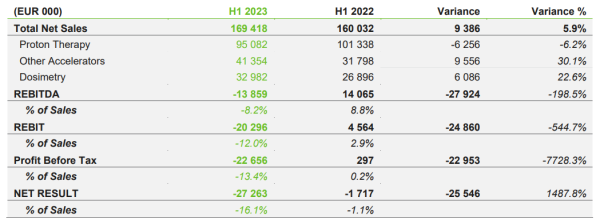

Financial summary

- Total H1 Group revenues of EUR 169.4 million, up 5.9% on the same period last year, driven by good Other Accelerators backlog conversion, strong Dosimetry sales, and Service revenue growth, but dampened by slow uptick in Proton Therapy

- Group REBIT of EUR -20.3 million affected in H1 by:

- Proton Therapy revenue recognition, largely linked to phasing of projects and some unrelated, customer-specific installation delays. As a result, strong improvement is expected in H2, with revenue recognition on five projects planned in H2 and three project shipments or installations shifted to H2

- Investment made at Group level in digital development, supply chain and research and development to prepare for growth in the next quarters

- Strong focus on inventory build-up during the period, with an increase of EUR 33 million (up 32.4%), in preparation for backlog execution in H2 and beyond, in particular following the 10-room Proton Therapy deal signed in 2022 in Spain

- Gross margin was 26.6%, down from 39.1% last year, impacted by inflation, low overhead absorption and product mix; last year’s numbers also included the one-off positive impact of indemnities related to Rutherford in the UK

- Equipment order intake was EUR 88 million and Dosimetry order intake rose 20.2% to EUR 36.9 million

- No change in guidance, with growth to 2026 REBIT target weighted to after 2024

- Dosimetry had a strong half year, with REBIT up 200% on last year to EUR 3.2 million, with the business unit increasing its customer base and global reach

- Continued strong performance of Services with PT revenues increasing 10% versus H1 2022 and overall Service revenues increasing 16.8%

- Equipment and Services backlog remains high at EUR 1.3 billion, with equipment and upgrade backlog reaching EUR 707 million; operational measures in place to support backlog conversion

- Total Group net loss of EUR 27.3 million (H1 2022: EUR 1.7 million loss), reflective of revenue recognition weighted to the second half

- Strong balance sheet retained with EUR 103.3 million gross cash and EUR 61.7 million net cash position. EUR 41 million undrawn short-term credit lines still available at period end

Read the full Press Release Here: